Mietkautionsbürgschaft for Renting apartment in Germany

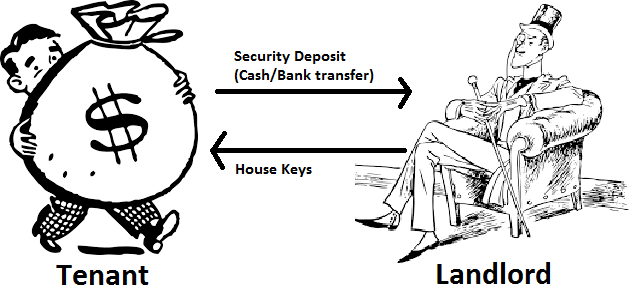

Have you finally found your dream apartment/house? – bright, spacious, and well located; and the only thing you have to do now is to sign the rental contract to secure the apartment. But, all apartment owners/landlords need some security that you will pay the rent and any damages you cause to the property. This security deposit is called Kaution in German. It should be usually paid to the owner while signing the contract (or before moving into the apartment, if the owner is understanding). Kaution can be as high as three times your cold rent (Kaltmiete). So, if your cold rent is 700 Euros, you may end up needing 2100 Euros for Kaution.

While moving into a new apartment, you may have various expenditures like buying new furniture and electronic items (Like a fridge, washing machine) and/or paying for a moving company, etc. At this point of time, you may not have enough money to pay the deposit in cash; or you may not be willing to pay so much money in cash upfront as you may need it for later use. An easy alternative to paying the money in cash is getting a Mietkautionsbürgschaft.

What is Mietkautionsbürgschaft?

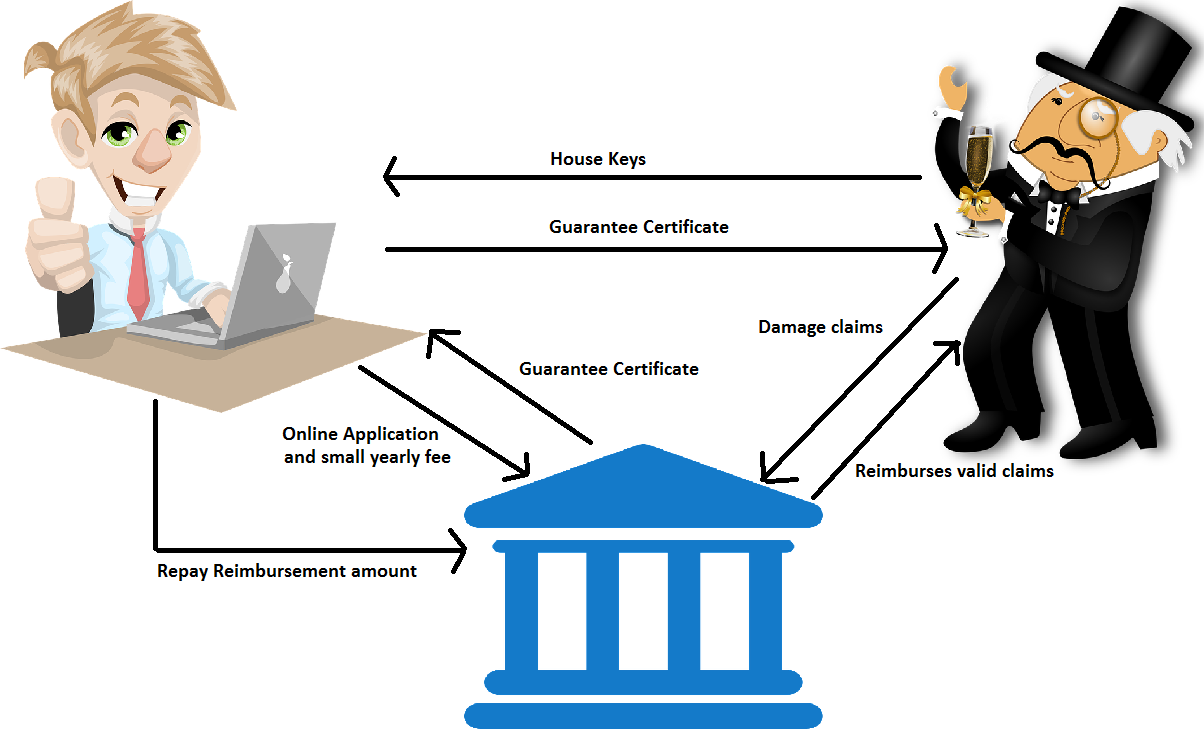

Mietkautionsbürgschaft is a security deposit guarantee (a.k.a. Security deposit insurance). The tenant has to pay a small yearly fee (around 3~6% of the deposit amount) to a trusted third party (guarantor) which in return gives the tenant a security deposit guarantee certificate. The guarantors are recognized private individuals, credit institutions or insurance companies. The tenant then gives the landlord this certificate instead of the cash deposit. This would mean that the landlord will now turn to the third party (and not to the tenant) in case of damage to the property for reimbursement.

At the end of your contract period two conditions can occur:

- No damages: In this case, the tenant must take back the guarantee certificate from the landlord and send it back to the guarantor. Once the guarantor receives the certificate, the tenant must not pay any fee to the guarantor.

- Damages to the property: In this case, the guarantor must claim the reimbursement of damages from the guarantor. The guarantor will check the claim and pay the amount (if the claim is valid). After that, the tenant must take the certificate back from the landlord and send it back to the guarantor. The tenant must also repay the reimbursement amount to the guarantor. Once the guarantor receives the certificate and the reimbursement amount, the tenant must not pay any fee to the guarantor.

SEE ALSO: How to find an apartment in Germany?

For whom is Mietkautionsbürgschaft suitable?

The rent deposit guarantee is suitable for all tenants who want to keep the money for the rental deposit and want a safe and cashless alternative.

The rental deposit guarantee is the appropriate solution if:

- You want to have assurance about your money and keep a better track of it by keeping it with you, instead of waiting for years to come, because it is deposited as a cash deposit with the landlord.

- The repayment of the old rental deposit is still outstanding. Instead of having to provide a deposit of up to three net cold rent a second time, the waiting time until repayment can be bridged with a guarantee for the new apartment.

- There is a desire to improve the standard of living: wishes like a big trip or new furniture can be realized.

- You want to be more secure: claims by the landlord are checked by most guarantors before payment. The landlord can no longer withhold the rental deposit unlawfully.

- Additional benefits:

- In case of involuntary unemployment, many guarantors don’t charge any fees for the duration a tenant remains unemployed (But most guarantors will not provide a guarantee certificate if the tenant is unemployed to start with).

-

- You can receive the guarantee certificate within 2-5 days after a successful application.

Disadvantages of Mietkautionsbürgschaft

- Tenants have to pay a yearly fee (around 3~6% of the deposit amount)

- Not all landlords accept Mietkautionsbürgschaft. Although Mietkautionsbürgschaft is quite widespread in Germany, some landlords still insist on cash deposits.

How to apply for a Mietkautionsbürgschaft?

Completing a security deposit guarantee is uncomplicated and will only take a few minutes. All you need is a computer or a smartphone with internet access. However, it is also possible to apply by post for most guarantors.

The following steps should be followed:

- The tenant must provide his personal information, the amount of the rental deposit, the address of the landlord and the property to be rented, and bank details (The guarantor may check your SCHUFA rating. Read what is SCHUFA here).

- After the application has been completed, the tenant will receive the guarantee certificate within 2-5 days.

- The tenant should now hand over the certificate to the landlord instead of the cash deposit.

For those who already have paid their security deposit in cash, can also opt for a Mietkautionsbürgschaft and receive their security deposit back (talk to the landlord before applying for Mietkautionsbürgschaft).

SEE ALSO: What should I know before signing a rental contract in Germany?

How to search for a Mietkautionsbürgschaft?

You can use a Mietkautionsbürgschaft comparison site like Mietkautionsbuergschaft.de. Just enter your required security deposit amount and click “Jetzt vergleichen” to see offers from different guarantors.

Please subscribe to our blog to be informed about the updates or like us on Facebook.

Download our Android app from the Google Play store to get all the information about, living, studying and working in Germany all in one place.

More from Study in Germany

FAQs about Studying in Germany | Airports | Preparation and Arrival | Masters | Bachelors | PhD | Student in Germany | Life in Germany | Part-time Jobs | Working in Germany | Driving in Germany | Housing in Germany | Integration | Comparisons between Countries | Traveling in Europe

Leave a Comment